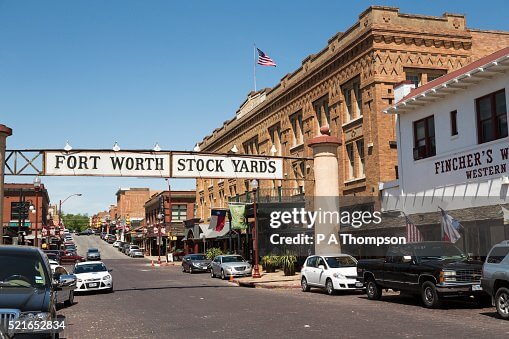

Personal Loans for Bad Credit in Fort Worth, TX

Trying to get approved for a loan with bad credit may feel like a headache and a hassle. The good news is that a personal loan may be an option for people with bad credit* in Fort Worth, TX.

In this article we’ll go over:

- What is a bad credit score?

- Specific factors that may impact loans in Fort Worth

- Other payment solutions for Fort Worth, TX residents

Before taking out any loan, it is a good idea to check your current financial situation and if possible, assess the loan details. Important considerations include repayment terms and monthly payment amounts.

Getting a credit check with each credit bureau can also be a good place to start. Putting together a budget may also help you determine what approval amount you may need.

Understanding Bad Credit

Bad credit may be caused by several factors, such as missing credit card or auto loan payments or paying them late. Also, having a high credit utilization or simply having too many inquiries may be a contributing factor to an imperfect credit score. A credit score below 579 is considered poor and usually unfavorable for securing loan approval with traditional lenders or credit unions.

An imperfect credit score may make it harder to receive approval for a loan, or even to rent a home. But there is good news ahead: there are options for those with bad credit, such as alternative payment solution providers. With alternative payment solution providers, having poor credit or no credit history does not necessarily mean you will be denied.

Fort Worth or Texas-Specific Considerations

Applying for a personal credit loan in Texas is straightforward. Currently, the state doesn’t have numerous regulations that could complicate getting approved for a personal loan with bad credit.

However, the low regulations mean that some lenders may charge higher interest rates in Texas than in states like California. Although not as plentiful as other states, Texas offers a few resources for credit counseling. If you seek a credit counselor’s help, be sure they are a government-approved credit counseling service.

Personal Loan & Alternative Options in Fort Worth, Texas

A bad credit personal loan may be an option for people with bad credit to secure the services and products they need or want. A bad credit loan may come in handy for costly products like electronics and offers options to pay over time instead of all at once.

You might be wondering: Is a lease the same as a loan?

Leases & loans are quite different – here is what you need to know:

- A loan (or personal loan) is generally a lump sum of funds provided on the recipient’s behalf that is paid back over time (and, like most loans, includes interest.)

- A lease (or lease-to-own option) allows the recipient to possess the leased item for a pre-determined period and includes the option to purchase the item outright. It does not include interest but has leasing fees.

What Products or Services Can a Bad Credit Loan Get You?

A bad credit loan may be used for a variety of purchases.

Many people secure a personal loan to get the things they need, like new appliances. Between prices of appliances going up and new appliances not lasting as long as in the past, these reasons may cause people to make purchases before they (or their budget) are ready for the additional expense.

Bad credit loans may also be used for electronics, like game consoles, smartphones, or even a laptop.

Here are some other items that you may be able to purchase with a personal loan:**

As a note, the specific products borrowers are looking to secure are at the discretion of the lender or merchant, so check with the merchant to see if they offer the product you are looking to secure.

Fort Worth, TX Bad Credit Loan FAQs

Q: Will Alternative Payment Solution Providers Perform a Credit Check?

A: Alternative payment solution providers offer loan options for people with bad credit, but they may still run a credit check.

Lenders and alternative payment solution providers may perform a credit check to determine eligibility, the loan amount, or interest rates. Carefully read the disclosures and if possible, agreement terms before filling out a loan application to determine if a lender will perform a credit check.

Q: Can You Realistically Get a Loan in Fort Worth with Bad Credit?

A: Yes, it may be possible to be approved for a loan in the Dallas/Fort Worth area even if you have bad credit.

Just because you have bad or poor credit doesn’t mean you’ll be automatically denied. Start the application** today to see how much you may be approved for.

Q: How Can I Apply for a Bad Credit Loan?

A: Applying for a bad credit loan can often be done by completing an online application process.

Get started today using our convenient tool** to locate participating retailers in Fort Worth, TX. From there, you can complete the loan process online to see if you are approved.

*Approval is possible without a credit score, but credit may be checked.

*Please Note: Payment solutions vary based on the merchant and will be indicated at the beginning of the application process. Be sure to confirm that the merchant you select offers the lease, loan, or alternative payment solution you intend to apply for.